Thus far, 2022 has been a rough year for investing in ESG (Environmental, Social and Governance). It has been run up the flagpole by the media, made into Swiss cheese by its opponents and its returns have, in most cases, lagged those of the overall market. On the precipice of the November COP 27 meeting in Egypt (the 27th United Nations Climate Change Conference), the world is seeing increasing emissions, increasing energy insecurity, and decreasing confidence controlling global warming. Despite, or maybe even because of some of these issues, BSW believes that ESG investing still has merit, should offer competitive long-term returns and will continue to be an essential element for needed change.

ESG Recent Performance

It’s important to understand that ESG investing is different things to different people – I’ll be driving this point home throughout this piece so, for now, let’s bookmark this nuance. Despite the varied ways to allocate to ESG stock investing, most strategies share three common themes (or factors) that manifest in what ESG investing is attempting to accomplish. Compared to traditional stock indices, ESG strategies tend to be skewed towards the Growth style of investing, typically are more heavily weighted to the Quality factor, and generally have less exposure to stocks within the energy and utility sectors.

These deviations have resulted in performance differentials versus a traditional index over time. Until this year, and particularly since the Great Financial Crisis (GFC) of 08’/09’, these deviations have mostly been to the upside. This year, however, investors have seen a reversal in the factors that have driven ESG investing to outperform.

The main driver seems to be the energy sector’s massive outperformance. Through November 3rd, the S&P 500 Energy sector is up 64%, while the sectors typically with the most representation within ESG investing (Info Tech and Communications Services) are down 32% and 35%, respectively. Fortunately for ESG investors, energy now only makes up ~5% of the S&P 500 – down from over 15% in 2008.

We’ll circle back to the incredible shrinking energy sector and why ESG has been blamed for contributing to the current state of energy insecurity. Suffice to say that there are many factors at work here and that the way investment capital was or is put to work may only be a small piece of the puzzle.

Another headwind for ESG this year has been the Growth to Value rotation. In an environment of rising rates, many investors have favored Value strategies over Growth oriented strategies. This is not unusual. In a rising rate environment, growth usually slows, which creates uncertainty around the ability of fast-growing stocks to consistently improve earnings. Given the fact that these types of stocks – think technology, biotech, information services, and the like – sell for high multiples on these earnings, they are vulnerable to any downward adjustments in growth expectations. We have seen this in spades this earnings season. Facebook (Meta), Google (Alphabet), Tesla and Amazon stocks have given back, in some cases, years of gains in mere months.

The wind in the sails of growth stocks since the GFC has been a flood of liquidity into the financial system and interest rates that, for the most part, have been held at or near nil – also remember that until recently, the world had nearly $19 trillion of negative yielding debt!

Investors were essentially driven into stocks and didn’t mind waiting for future earnings of high-growth stocks to pan out since, after all, they were not making any money in bonds, savings accounts, or money markets. In fact, the prevailing thought may have been something like – why not gamble on small stocks that don’t currently make any money at all, provided the payoff looks good a few years out.

In our view, that thought process doesn’t hold water if, for instance, an investor can now get 3%+ on money market and over 4% on treasuries. The opportunity cost of foregoing currently available higher yields results in the value of those future earnings going down and by extension, the price of those types of growth stocks.

Lastly, ESG strategies generally are more heavily weighted to the Quality factor. Quality stocks are those that typically have more stable earnings, stronger balance sheets (less debt) and higher margins. This tends to rule out many cyclical, capital intensive companies. As it happens, those cyclical companies, along with other less-quality companies generally do well in an inflationary, rising rate environment. Inflation lessens the blow of their debt loads (they are being paid back with dollars that are not worth as much), it creates an opportunity for them to raise prices; and since they have high fixed costs and not as many variable costs, the higher prices fall right down to their bottom line in the form of higher margins.

Given the confluence of events as detailed above, one can easily see how ESG has unperformed this year. However, in our opinion as a long-term investor, 11 months should not define a strategy. We think there are many reasons to believe that ESG will again have its day in the sun – nay its upcoming decades in the sun. Below, we’ll discuss some reasons why we are in this camp.

Attacks on ESG

“ESG – Three letters that won’t save the planet” The Economist July 23, 2022

“One of the Hottest Trends in the World of Investing Is a Sham” The New York Times September 29, 2022

Above are two examples of articles put out this year that decry the merits of ESG investing. At a high level, they bring to attention the lack of consistency in ESG measurement and the absence of a defined standard by which all ESG investments can be held against.

In summary, the articles claim the following:

The measurement of Social and Governance issues specifically (the “S&G” in ESG) is too broad, and issues are too diverse to have any meaning.

-

- BSW agrees. That’s why BSW’s goal is to invest with managers that use unique and targeted Social and Governance data sources to uncover both positive and negative stakeholder externalities. In our opinion, it’s not enough to rely on the big two screening services – MSCI or Sustainalytics. In addition, BSW prefers a stock manager that can align a stock strategy with specific issues within the “S” and “G” areas of ESG that are most important to an investor and that attempt to move the needle according to their values.

Greenwashing is prevalent within ESG investing and has resulted in undifferentiated products with higher fees to investors.

-

- BSW also agrees. BSW looks for managers that have invested as much or more into their ESG analyst team and resources as their stock and bond analysts. In our opinion, it’s not enough for ESG managers to simply “integrate” ESG risk analysis into their investment process. We believe the ESG rigor needs to stand on its own. BSW believes in speaking with all our ESG managers. Through these discussions we hope to glean the level of their ESG commitment, their preparedness for an SEC exam on their ESG methodology and their process for incorporating ESG screens within their investment process.

Investment management companies add ESG to their strategies to boost fees.

-

- Unfortunately, it appears this is happening within the industry. As of right now, it seems that any firm can put “ESG” onto the title of their fund and get away with it…we hope this is going to change. The industry has seen an uptick in lawsuits across Europe that hold large investment firms liable for greenwashing and the SEC recently announced its intent to review.

More regulation around ESG is needed.

-

- BSW agrees. We believe that if all managers and advisors were held to a higher standard, it might lead to a major shake out of questionable funds. More regulation also potentially could give the public more confidence that investment managers are doing what they claim and might drive more investment dollars towards ESG investing.

ESG returns cannot outperform.

-

- BSW disagrees. Over longer periods of time, avoiding negative externalities and embracing positive externalities should result in market returns with potentially less volatility. We believe ESG as a risk management tool could be powerful. To us, evaluating firms on their balance sheet and income statement alone in today’s economy and in today’s hyper-connected world is not enough. Our view is that if data on carbon emissions, board diversity, employee satisfaction and consumer views around a company are available, why not marry this data with traditional financial analysis.

Measurement of ESG data and its rating agencies need an overhaul.

-

- BSW agrees. Along these lines, BSW aims to invest in active ESG managers that do not take ESG rating service data at face value. Believe it or not, ratings agencies disagree with each other upwards of 50% of the time! BSW wants managers to step back and ask why the ratings disagree (their methodology/focus etc.) and then build a framework to triangulate to the most relevant data for the ESG issue at hand. Some of the managers we invest with don’t rely on the rating agencies at all – preferring to build their own databases and methodology that go far beyond ESG negative risks. Still others throw all the ratings out the window and instead focus on what a company’s products or services are doing to solve society’s environmental and social challenges.

At the end of the day, ESG is NOT a one size fits all investment strategy. Most of what the above articles focus on is based upon general, mainstream ESG strategies that claim to be good for everyone.

Unlike the one size fits all approach, BSW’s goal is to take the time to understand the themes and issues that are most important to our clients – based on their personal values. BSW attempts to select targeted strategies that focus on those theme/s – whether E, S or G; or some preferred weighting amongst the three legs.

Depending upon what is emphasized – E, S or G, a company can pass or fail ESG screens. In our opinion, it doesn’t make that company “good” or “bad”, but rather buckets that company into a category that may or may not align with an individual’s vision for a better future. That’s it.

Just like there are many ways to run an ESG strategy, there are literally hundreds of different strategies when it comes to stock investing in general. We’ve already called out Value investing versus Growth investing, but there are a wide range of other approaches: GARP (Growth at a Reasonable Price), market neutral, long/short, momentum, sector rotation, high dividend, dividend growth, active, passive, equal weight, cap weight, buy and hold, small cap, large cap, Dogs of the Dow…you get the picture. None have been called out as controversial, imprudent, or potentially politically motivated.

On that last point, we feel it’s unfortunate that ESG investing has been associated with politics. Last we checked, an earth less exposed to climate change risks benefits all humans – left, right, or otherwise. The same could be said for societal issues. History has shown that countries, no matter what the entrenched political state, typically do not live up to their full potential without promoting equality, health, education, and a sense of wellbeing.

Strange as it might seem on the surface, certain U.S. political leaders have made it illegal for their state pension plans to invest in ESG strategies. The argument is that these plans have fiduciary duties to their pensioners and therefore investment returns and only investment returns should be the consideration of investment. By this same reasoning, one could argue that Value strategies should have been barred since its returns have lagged Growth strategies for 20 years through 2021!

To make matters even worse, certain actors wants to restrict your rights as a shareholder to put forth proxy votes. The argument is that corporations have had to devote undue time and effort to address shareholder advocacy efforts. If enacted, these rules would silence smaller shareholders that may not have the means to hold large positions in a company. Having a vote and a voice in the operations of a public company in which one holds shares has long been a benefit of owning stock. Importantly, it is a way to keep public firms in check regarding their shared mission of increasing shareholder value.

BSW’s Vision for the Future of ESG Investing

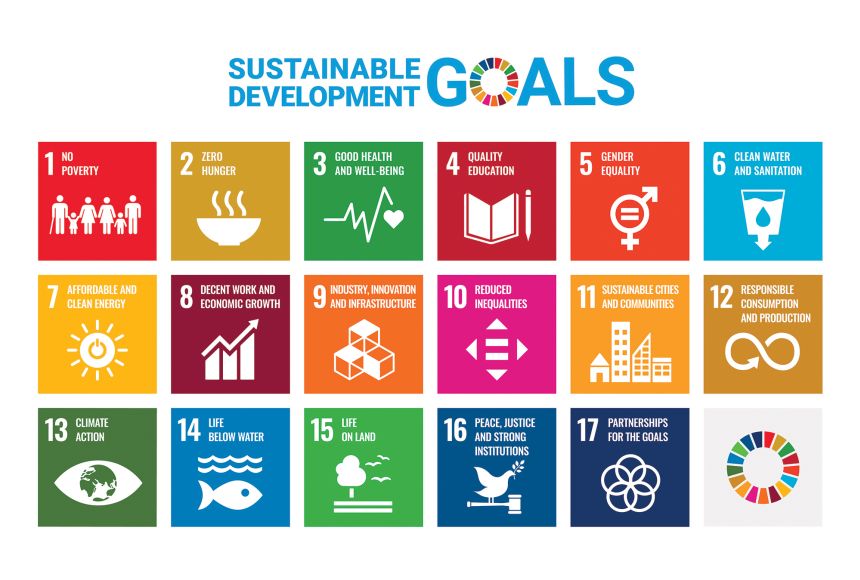

When BSW started investing in ESG strategies in 2004, it was called SRI (Socially Responsible Investing). Investment strategies that even purported to consider ESG were few and far between. Two years later, in 2006, the United Nations Principals for Responsible Investment was launched. It was an agreed upon framework, crafted by world leaders, which established guidelines for investors to incorporate ESG issues into investment practices. This framework was strengthened in 2015 with the advent of the UN Sustainable Development Goals (UNSDGs). All 17 goals were devised and agreed upon by the 193 member states. At their heart, they are a call to solve the world’s most pressing development challenges.

Over the past 10 years, ESG investing has gone through growing pains as more investment capital has moved in its direction (as of 2020, studies show that ~33% of all U.S. assets under management were ESG oriented). Per the ESG articles above, this has, unfortunately, resulted in an industry that, when looked at from the investment treetops, is an inch deep and a mile wide.

Over the past 10 years, ESG investing has gone through growing pains as more investment capital has moved in its direction (as of 2020, studies show that ~33% of all U.S. assets under management were ESG oriented). Per the ESG articles above, this has, unfortunately, resulted in an industry that, when looked at from the investment treetops, is an inch deep and a mile wide.

However, operating from the ground level as BSW does, our goal is to spot the managers and strategies that are in the mile deep and inch wide category. These are the managers we feel are transparent, thoughtful with their approach and have a defined and repeatable process. They also have people (not machines) at the helm that try to make sensible, consistent decisions around ESG data.

There are many ways that active managers define and implement their investment strategies. Returning to our Value style example: some Value managers won’t touch stocks over a certain P/E ratio, some consider growth stocks that have fallen in price “value”, some simply pick the cheapest stocks in each sector. Similarly, ESG managers have many ways to determine both their universe of eligible stocks and how those stocks come together in a portfolio.

The issue, in our opinion, is not so much that all these ESG styles of investment need to have absolute consistency, but rather investors need to know what they are buying. We believe the industry needs to do a better job of letting investors know what they are investing in, the methods by which stocks go into a strategy and what ESG data sources are being used – if any. This may create more comfort for investors to align their investments with their values if they choose.

When all is said and done, BSW believes ESG has a bright future. Regulation, if thoughtfully done, will level the playing field for ESG investors, may up the game of ESG managers, and hopefully will result in an ESG landscape that leads to more adoption, less controversy, and, importantly – investment capital flowing to those companies that are working to solve societies most challenging issues (UNSDGs).

As an important aside, whether one chooses to dedicate their investment capital to the ESG-style of investing is an individual choice. In BSW’s view, there is no right or wrong way.

For investors that want to align their values with their investments, this may be the time in our opinion. When you consider that the investments that go into most ESG strategies are aligned with outcomes that are often prioritized and incentivized by countries around the world, there may be a steady tailwind for years.

A common proverb within the investing world is “follow the money.” Who has the most money? Those who can print it and borrow almost unlimited amounts – sovereign governments.

As an example, both China and the U.S. have put a priority on lowering carbon emissions. Both have committed to the development of electric vehicles, clean energy, and the advancement of the components and infrastructure that support these initiatives.

In the U.S., part of the newly enacted Inflation Reduction Act (IRA) provides funding for the U.S. manufacturing of solar panels. First Solar, a stock found in some of the ESG strategies in which we invest, was suffering this year until it became apparent that, being a U.S. manufacturer of solar panels, it was going to have the backing of the U.S. government. It went up 125% in a matter of 4 months.

Going beyond solar panels, the IRA created the largest ever investment in climate and energy in U.S. history! Through the Department of Energy’s Loans Programs Office (LPO), the IRA has made over $300B of loans available to companies developing exciting technologies to tackle climate change.

For those that don’t know Jigar Shah, as Director of the Loans Programs Office he likely has just become a crucial player in the country’s climate transition. Through these loans, some of the private companies on the leading edge of energy transition might just be the next big ESG investment opportunities! Click on the video below to see what the LPO and Jigar are doing…

Likewise, in China, President Xi Jinping recently called out EV production and clean energy as a priority in his every 5-year address to China’s Congress. Within China, it is not unusual for the government to take a stake in companies that it wants to succeed. Implicit backing becomes direct explicit backing and, as a result, much of the business risks associated with a growing company may be minimized.

Outside of the U.S. and China, another organization that was formed to help low- and middle-income countries mitigate climate change is the Climate Investment Funds (CIF). CIF has been taking donations from government and private donors since 2008 and now has $11B to lend. It recently sent $1B to coal-dependent South Africa and Indonesia to transition some of their existing energy plants to renewable energy facilities.

Have governments always been the best allocators of resources? No. Are they good long-term planners? No. Especially not in the U.S. where, unfortunately, politicians have tended to focus on short-term goals that can be achieved within their term limits.

This has led to start/stop policies here in the U.S. and questionable expectations just about everywhere. Case in point is the general under-estimation of the timeline to build a bridge to a less carbon intensive world. It cannot happen overnight and yet policies were put in place in Europe and elsewhere that may have assumed a shorter timeline for implementation. This has resulted in underinvestment in critical energy infrastructure (maybe reflected in the incredible shrinking energy sector) that might help ensure we get to a cleaner future in an orderly and secure way.

All this is to say that the underlying themes and goals of ESG investing have committed cheerleaders in governments all over the world. As evidenced by the current wobbly energy transition, we don’t expect that these goals are met tomorrow, or that the path to success doesn’t come with its own growing pains and detours along the way.

As governments naturally shift over time, as policies wax and wane, we’ll continue to see bumps along the road. However, if one can imagine a world where the UNSDGs are prioritized, embraced, valued, and hopefully met; that world is the destination – ESG’s destination.

Governments alone cannot get us to that world. Society needs private and public companies to shoulder the business risks, to innovate and to be forward looking in the products and services they offer that may help get us to that objective – a sustainable, better place for future generations.

Thanks for reading.

This blog is created and authored by BSW Wealth Partners, Inc., a Public Benefit Corporation (“BSW”) and is published and provided for informational purposes only. The opinions expressed in the blog are our opinions and should not be regarded as a description of services provided by BSW or considered investment, legal or accounting advice. Certain information sited is from third-party sources and while we believe the information to be accurate and true to the best of our knowledge, we cannot guarantee its accuracy as there may be certain unknown omissions, errors or mistakes. Use of third-party information, including links, is in no way an endorsement by BSW. The views reflected in the blog are subject to change at any time without notice.

Nothing on this blog constitutes investment advice, performance data or any recommendation that any security, portfolio of securities, investment product or investment strategy is suitable for any specific person. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by BSW), or any non-investment related content, made reference to directly or indirectly in this blog post will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Not all BSW clients will have the same experience within their portfolio(s) and certain topics discussed in this blog may not apply to all clients or investors. Due to numerous factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from BSW. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. BSW is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of BSW’s current written disclosure statement discussing our advisory services and fees is available upon request.

It is important to understand that utilizing ESG-specific investments and investments that BSW perceives to have an intentional or measurable impact, does not guarantee that investment selections will align with specific sustainable values that you may have, but will instead be invested in accordance with BSW’s criteria for investment selection. ESG scores and ratings may differ from one investment to another. It is important to note that how a firm and/or portfolio manager analyzes and identifies ESG factors may not reflect how another firm and/or manager does respective research.

Further, the underlying holdings of pooled ESG investment vehicles may or may not offer the same level or scope of ESG information as other companies and, therefore, data may not be consistent across the board. As a result, some investments may not capture sustainable concepts with 100% accuracy. Therefore, we may rely on portfolio or fund managers to establish their own system of ranking and sustainable factors in coordination with their mandate.

Utilizing ESG-specific investments does not guarantee a certain level of performance. The investment universe of ESG-related investment vehicles is by nature narrower in scope and therefore your investment options may be limited. Further, by narrowing the scope of investment options you may or may not be missing out on an opportunity or sector that could contribute to overall performance. ESG-mandated investments may have a higher expense ratio than traditionally managed investment vehicles.