If you feel like a lot is going on in the world and, by extension, with financial markets, you are justified in feeling that way. A recent article by The Economist highlighted the fact that levels of stock volatility, bond volatility and economic uncertainty are currently at elevated levels. All this is being driven by high and more persistent inflation, for which the market was ill-positioned to deal. With interest rates just recently at decade lows, the move higher in borrowing costs has been swift – pressuring the very impulse that drove markets to frothy levels last year.

The “R” word has reappeared in just about every financial article for the past month. In a previous blog post I highlighted why this is not the end of the world as we know it. While I won’t repeat myself here, I will update the fact that certain economic indicators have rolled over even more and are now pointing to an economy that may have barely grown in Q2.

If we do go into a recession (there, I said the word – it’s not so scary), we will only know in retrospect. The NBER will put its official stamp on it but, importantly, corporations and consumers will deal with it – possibly adjusting their company and family budgets prudently at the margins.

I was reminded by a Howard Marks article recently that the economy moves rather slowly and with little fan fair. Research shows that an absolutely great year in the U.S. economy equates to 4-5% growth. A bad year is negative 3% and the average has hovered around 2%. Certainly not eye-popping numbers. Why then does the stock market swing around so much?

At their core, stocks are a levered bet on the economy. This is because corporations not only take on leverage in the form of debt obligations but they make strategic decisions that rely on accurate economic assumptions over time. Over the longer run however, stocks have returned GDP plus 4-5% (to account for the leverage and optionality to improve over time). On a long-term time horizon, it’s like watching paint dry.

In that vein, it’s important to remember that even though we are in a bear market in stocks (BSW’s benchmark the ACWI is down 20.44% YTD through June), investors are likely getting ever closer to the recovery phase. Not once has the market failed to recover from a bear market eventually.

Though often uncomfortable to ride out, bear markets have produced substantial (and often swift) recoveries. The economy traditionally spends a small amount of time in a bear market and much longer periods in uptrends. Staying invested through these downturns, rebalancing and remaining disciplined should help ensure that investors catch the full upswing in the market.

Unlike previous bear markets, this downturn has been precipitated by a rise in long-dormant inflation. The overall economy, consumers and the financial system were all on firm footing prior to inflation shooting higher. The Federal Reserve is committed to fighting inflation with a very blunt tool – interest rates. Interest rates are considered blunt because 1.) they work on a time lag and 2.) they only impact the demand side by making it more expensive to borrow.

If inflation remains “considerably” above its stated target of 2%, indicators are that the Fed will continue to raise rates. We can debate what “considerable” means but, in my opinion, there’s no doubt the recent reading of 9.1% CPI inflation is in that camp.

What is the likely path of inflation and what does this mean for my portfolio?

The two charts below seem to illustrate it best. It seems that for the time being, inflation is here to stay. Even if we have ZERO inflation for the rest of the year, we will finish the year at ~6.5% inflation. If we revert to the mild inflation impulses of the pre-covid world, we end up at 7.5% inflation. To get below the 6% mark on inflation this year, the economy would need to experience outright deflation the rest of the year

This seems to be untenable for the Fed. Inflation is insidious because it negatively effects everyone in society and especially those that spend most of their salary on non-substitutable items that have gone up in price – like food and gas. Of great concern to the Fed is the fact that the “sticky” parts of CPI inflation (those prices that take time and considerable effort to raise) have become unanchored and are rising quickly.

The stock market, for now, is taking a back seat in terms of the Fed’s priority. In the past, the Fed has come to the rescue of the market at the first signs of a wobble. This time, inflation is the difference.

Portfolios obviously have struggled in this environment. The good news (yes: there is some good news) is that despite the potential for more near-term challenges, we see some silver linings that should result in continued long-term gains going forward.

- In this environment, bonds are offering yields that should look very good when looking back in a few years. This is because we believe the likely path of bond yields going forward is lower for longer.

- By raising rates aggressively up front, the Fed is essentially banking ammunition in the form of interest rate cuts in the future. As soon as the market catches wind of a potential interest rate cut, stocks (and other risk assets) should be off to the races.

- If the Fed starts cutting, our hope is that it does not cut all the way back to 0%. A higher “terminal rate” would encourage financial prudence on the part of both households and corporations.

-

- If you think of the financial markets as a pendulum, it swung one way to an extreme during the pandemic and then swung back too far during the subsequent recovery.

- Getting back to some middle ground in terms of not too tight, not too loose financial conditions would be more sustainable and should result in a longer recovery phase.

-

- In speaking with some of our stock managers, within certain sectors and market caps, they are seeing once in a lifetime type entry points. We are not quite there across the board yet, but are getting closer (this earnings season will be telling). In fact, one manager is using its own balance sheet to double down on their stock strategies at current levels!

- While inflation is set to continue hot through this year, there are two forces that will likely be naturally driving it lower next year (aside from higher interest rates).

-

- Higher prices are typically the cure to higher prices. In other words, at a certain level, high prices cause consumers to cut back or stop buying altogether – thereby naturally curtailing demand.

- Simple math. Inflation is calculated on a year over year basis. We are currently comparing current price levels with those prices that were influenced by the pandemic. There are some nuances to this, but regardless, next year’s price base will be higher.

-

- Per the above bullet, our hope is that the Fed, in its relentless mission to drive current inflation down, does not drive the economy into too deep of a hole prior to prices coming down on their own. However, even if it does overshoot on tightening financial conditions, per the second bullet above, it will have the means to cut rates if need be.

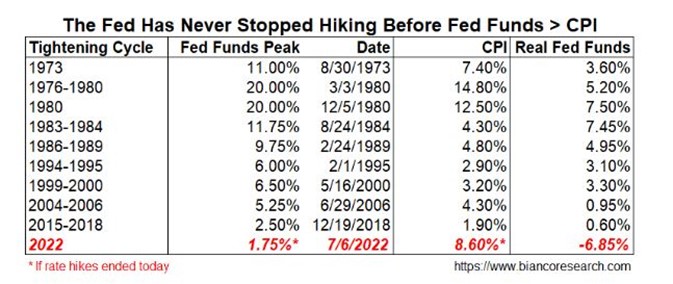

To sum it up, we believe that the current market environment will continue to be volatile due to the uncertainty around how high the Fed will hike and when it may stop. Of note is the fact that not once has the Fed stopped hiking rates until the Fed funds rate gets above inflation.

Current CPI is 9.1% and if a 75bps hike is baked in the cake for the end of this month, the Fed funds rate would sit at 2.50% in July. Again, the hope is that this 6.60% delta can be closed faster on the inflation side than on the interest rate side. The risk clearly is that inflation stays too high for too long and that the Fed will raise rates to the point where either the economy or the financial system cries enough.

No matter how the inflation movie plays out, BSW stands ready to take advantage of the situation. We fully expect the pendulum to overshoot on the downside, but importantly, only temporarily. We believe there is too much going well under the economic hood to warrant a sustained downturn.

BSW is getting close to a triggered portfolio rebalance. If it occurs, it will mean adding to stocks at attractive lower levels. This is important to remember. BSW is a serial purchaser of stocks. Once a portfolio is implemented it is not the last time a client will enter the market.

Pendulums are all around us – from the swing set at the playground, to the vibrating strings on a guitar. By keeping rates at 0% and mailing checks to citizens, the U.S. and the Fed essentially pulled the swing back and gave the market an “underdog” push (a technical playground term). After a launch like that, the swing will react in the opposite direction until gravity (or in this case higher rates) causes friction and slows it down.

While exhilarating for the one swinging, I always got in trouble by the playground monitors at school when I gave underdogs. Why? Kids get hurt at the pendulum extremes – the market is no different. BSW is already proactively planning for when the markets get back to the gentle, more predictable back and forth of a lazy porch swing. It’s impossible to know for sure, but it shouldn’t be too much longer – mostly because the market’s playground monitor, Jay Powell, is already blowing the whistle.

Thanks for reading and enjoy the rest of your summer!

This blog is created and authored by BSW Wealth Partners, Inc., a Public Benefit Corporation (“BSW”) and is published and provided for informational purposes only. The opinions expressed in the blog are our opinions and should not be regarded as a description of services provided by BSW or considered investment, legal or accounting advice. Certain information sited is from third-party sources and while we believe the information to be accurate and true to the best of our knowledge, we cannot guarantee its accuracy as there may be certain unknown omissions, errors or mistakes. Use of third-party information, including links, is in no way an endorsement by BSW. The views reflected in the blog are subject to change at any time without notice.

Nothing on this blog constitutes investment advice, performance data or any recommendation that any security, portfolio of securities, investment product or investment strategy is suitable for any specific person. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by BSW), or any non-investment related content, made reference to directly or indirectly in this blog post will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Not all BSW clients will have the same experience within their portfolio(s) and certain topics discussed in this blog may not apply to all clients or investors. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from BSW. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. BSW is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of BSW’s current written disclosure statement discussing our advisory services and fees is available upon request.