Safety and Security of Client Assets

For BSW, the safety and security of client assets are of paramount importance. Consequently, the strength, stability, and financial condition of our custodians (Schwab and Fidelity) are critical. Following Silicon Valley Bank’s (SVB’s) collapse, banks and financial intermediaries have come under deservedly heavy scrutiny. SVB’s demise was precipitated by losses on its bond portfolio following the spike in interest rates over the past year. And just as sharks can smell blood in the water from miles away, short sellers and market forces try to identify and exploit similar situations in other banks or companies. By and large, this is a good thing. As in SVB’s case, price discovery via the invisible hand punishes corporate weakness or poor decision-making.

Assessing Schwab’s Financial Condition and Risks

Recently, Schwab has been the subject of speculation and concern, as it also has a large portfolio of low-coupon bonds that are underwater. If these bonds, which are held both in Schwab’s Available-for-Sale (AFS) and Held-to-Maturity (HTM) portfolios, were marked to market or sold, Schwab’s Tier 1 equity ratio would be negative. This sounds dire, which is why it has generated buzz and is popular clickbait. However, unlike SVB or other banks that ran into trouble, Schwab’s loan-to-deposit ratio is a mere 10% (lower risk). For comparison, SVB’s loan to deposit ratio four times greater (higher risk).

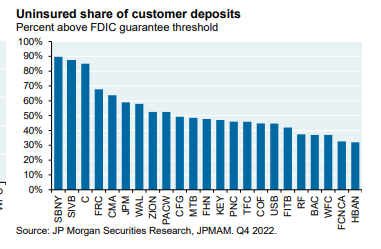

Meanwhile, Schwab’s uninsured deposits (ie, customer cash deposits exceeding the $250K FDIC insurance limit) are only 20%. SVB’s uninsured deposits were nearly 90%. The chart below shows uninsured deposit ratios of major, publicly-traded banks. In the chart, the higher the ratio, the higher the potential risk to those deposits; and the lower the ratio, the lower the potential risk to those deposits. If Schwab’s ratio were included in the chart, its ratio would be the lowest (ie, the least potential risk to those deposits).

Finally, Schwab custodies $7.5 trillion of client assets, which generate substantial profits. Schwab’s 2022 gross profits were nearly $21 billion. Of the 21 US banks and 11 European banks monitored by JPAM, Schwab’s return on assets for 2022 would be the third highest. In light of all this, we remain confident in Schwab’s strength, stability, and financial condition; and as a custodian for BSW client assets.

BSW’s Monitoring and Risk Mitigation Measures for Schwab Investments

Confidence, however, should not and does not suggest complacency. BSW’s Investment Group continues to monitor Schwab closely. Our Advisors have worked closely with our Portfolio Managers and Client Service Managers to identify cash balances in excess of FDIC limits and to invest those funds in position-traded money market funds for additional security (and yield). BSW’s COO Matt Samek and I have spoken with our primary Schwab contacts regarding these items — to separate fact from fiction and to understand Schwab’s position and planning. For more detailed commentary from Schwab on these matters, see this WSJ article (here), this CNBC interview with Schwab CEO Walt Bettinger (here), or this summary of Schwab’s asset protection (here).

One of the most beneficial elements of working with BSW is the “sleep at night factor.” So if you have any additional questions, please do not hesitate to contact us. We are here to help!

David Wolf, CEO