I consider myself very fortunate to ride my bicycle to work every day. It allows my thoughts to expand outside the influences of media and noise of the markets during my 20 mile round trip. The rhythmic cadence of pedal strokes and the breeze in my face seems to awaken the synapses and allow for deeper level of thinking. I highly recommend it.

Humor me as I take you through a recent cycling-induced analysis of recent market movements…

On a cool morning ride this week a recent Barron’s article popped into my consciousness. Andrew Lo, Professor of Finance at MIT, stated in an interview that, “Economists often view the market as a machine, subject to a set of rules and predictive models used in physics.” He goes on to say, “Think how complicated physics would be if electrons had feelings.” Essentially, Professor Lo is saying that the market is not always rational. It is a complex process, where different players with very different motivations, emotions and goals affect the conditions that we see (and often take at face value) every day.

The relevance in Lo’s observation lies in recent conversations with colleagues and clients (and with myself on the bike) about just how unusual the current stock and bond markets feel. I’ve been a student of the markets for almost 20 years and lately have observed dynamics that defy what I will call, “the accepted laws of finance”.

For example: 30% of developed market government bonds are now yielding less than zero. Investors are paying governments to borrow for up to 10 years! These investors are hoping for further bond price appreciation in these situations – like investors do when buying stocks.

Many U.S. large company stocks (like Clorox and General Mills) are being purchased solely for their dividend yields or income characteristics– like when buying bonds. Some of these stocks have current valuations that rival those of high-growth technology stocks. Stocks acting like bonds? Bonds acting like stocks?

We seem to be at a point in time where traditional financial models, formulas and relationships appear to be strained – not broken, but definitely strained. The hard and fast laws of statistics and mathematics have given way to the more lenient laws of psychology and nature, creating a feeling of randomness.

Illustration of a Lévy Flight – a mathematical pattern of movement found in nature.

The strangely beautiful image above is an illustration of a Lévy flight. It is an example of a behavioral model that is found in nature and is a result of social influences, rather than linear relationships. It is characterized by many small clustered moves combined with a few longer trajectories.

Sharks, squirrels, honeybees and spider monkeys have exhibited this movement when foraging for food. When they can’t find food in an orderly manner (foraging within a tight range), they instead shoot off in random directions –making long trips to a location, followed by closer inspection of the area in finer detail.

Remind you of anything?

This is the past 250 days of trading in our stock benchmark, the All Country World Index (ACWI).

Did the value of the underlying businesses within the ACWI index really experience the radical shifts in earnings prospects that the above chart would have you believe – and over such short periods of time? Most definitely not.

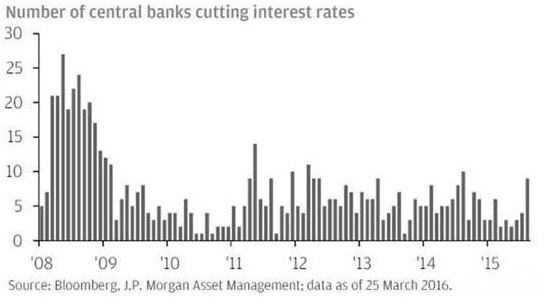

The current market environment, precipitated by years of central bank intervention, is lending itself to increased volatility and Lévy-like large moves with more frequent clusters of an attempt at price discovery. Price discovery has been difficult at best, because the building blocks of traditional finance (the risk-free rate), are being artificially tamped down by massive central bank intervention all over the world. According to JP Morgan, since September of 2008, central banks have cut interest rates more than 650 times. On average, this means that central banks have cut rates once every three trading days!

This is when having an awareness that markets may not be trading on fundamentals is an advantage. We know that ultimately, fundamentals will prevail and that these longer, exploratory market trajectories (on both the upside and the downside), represent opportunities for those subscribing to BSW’s investment framework for long term success:

- Remain disciplined with rebalancing.

- Remain diversified.

- Develop a portfolio asset allocation that will weather all types of markets.

- Keep long term goals defined and aligned with the portfolio asset allocation.

Along these lines, we are starting our semi-annual rebalancing within two weeks. We will be selling those assets that have outperformed, and will be adding to those assets that offer a better value. We will also be selectively tax loss harvesting (locking in losses to offset gains in the portfolio) in an effort to minimize your tax bill for 2016. We can’t stress enough that these disciplined actions perform no matter what the market environment, creating lasting value that compounds over time.

After the aforementioned and illustrated market gyrations so far this year, most investors would say that they have lost money. Without looking at a statement, that is the assumption. With all the negative hype and noise, how can the market be up?

“Markets climb a wall of worry” is one of the oldest phrases on Wall Street. Through June of this year, the market has had plenty of worry-fuel and has lived up to the wise saying. Through June, our benchmark, the ACWI, was +1.23%. Bonds are on track to put in a solid year. Our municipal bond benchmark was up 2.70% through June, with lower interest rates being a price tailwind.

BSW understands that we are in an unusual period. While market pundits try to explain and label each market swing, we understand what is happening and would point these folks to the squirrel darting off in search of food. Investors are doing the same— scurrying off in consequence of sentiment and emotion. We’ll let them scurry and stick to our discipline while we keep long standing fundamentals and your financial goals at top of mind.

Thanks for reading and enjoy the remainder of your summer!

Craig Seidler

Director of Public Investments