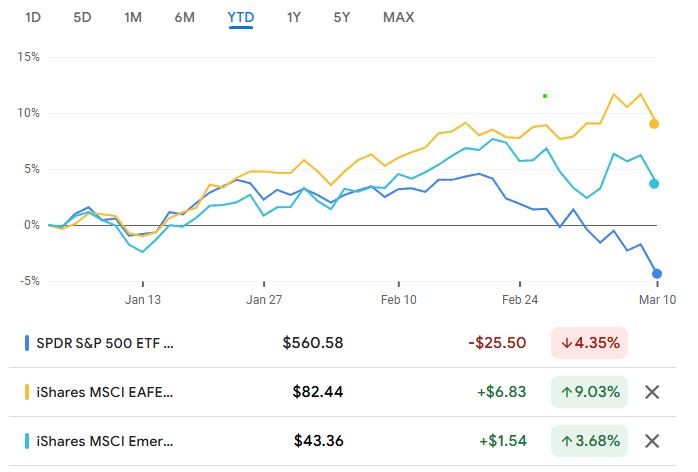

US markets tumbled more than -3% Monday and are down again today on a mélange of fears ranging from tariffs to recession, inflation, and general uncertainty. The post-election rally has completely unwound with the S&P 500 off -9% from its record high on February 19, 2025. As of yesterday’s close, major US indices are now negative for the year, with the S&P 500 down -4.35% year-to-date and the NASDAQ down -9.4% year-to-date.

While media outlets will no doubt focus on this swift reversal and the day’s losses, a lesser-known story is quietly unfolding. Although US markets have fallen in 2025, non-US markets are surging. Foreign-developed markets, as measured by the Europe Australia Far East (EAFE) Index are up +9.03% year-to-date, with emerging markets up +3.68% year-to-date.

According to BSW’s Director of Investments, Katherine St. Onge, “As discussed in our 4th Quarter Commentary, valuations on international equities were about half of those on US stocks, making them far more attractive on a relative risk/return basis. Outperformance by any market rarely persists, and these periods illustrate the benefits of global investing.”

With more than nine months remaining in 2025, year-to-date returns are just a fleeting snapshot in time, but today’s volatility is a good reminder of the broader investing opportunity set and advantages of diversification. As always, if you have any questions, please reach out — we are happy to help!

Katherine St. Onge, Director of Investments

David Wolf – CEO