“The only things certain in life are death and taxes” – but that doesn’t mean taxes have to be painful! Whether you’re a seasoned tax filer or tackling your returns for the first time, this guide will help you navigate tax season 2025 with confidence. We’ll try to make taxes a little more understandable so you can approach filing with more confidence, put the tax season behind you, and get back to what you really want to do. . . Make Life Better.

We know that everyone’s tax preparations happen differently. Whether you are self-filing or working with a trustworthy tax advisor, we’ve collected some of the basic information you need to know for the 2024 tax-year, and included a checklist to help you gather the right documents and know what you may be able to deduct.

Quick Tax Season Timeline

- Late January 2025: The starting gun! IRS begins accepting tax returns

- January 31, 2025: Watch your inbox – W-2s and 1099s arrive

- April 15, 2025: The big day! Federal tax returns due

- October 15, 2025: Extended deadline (if you filed for an extension)

First Things First: Understanding Your Taxable Income

Your taxable income is the portion of your gross income that the IRS deems taxable. This includes various types of earnings, from your regular salary and bonuses to income from freelance work, investments, and even unexpected windfalls like lottery winnings or canceled debts.

Think of taxable income as any money the IRS wants to know about (which is most of it!). Here’s what counts:

The Usual Suspects

-

- Wages and salaries

- Commissions

- Freelance earnings

- Bonuses and tips

- Rental income

- Interest or dividends from investments

- Prize winnings

- Bartered services

- Canceled debt

- Unemployment income

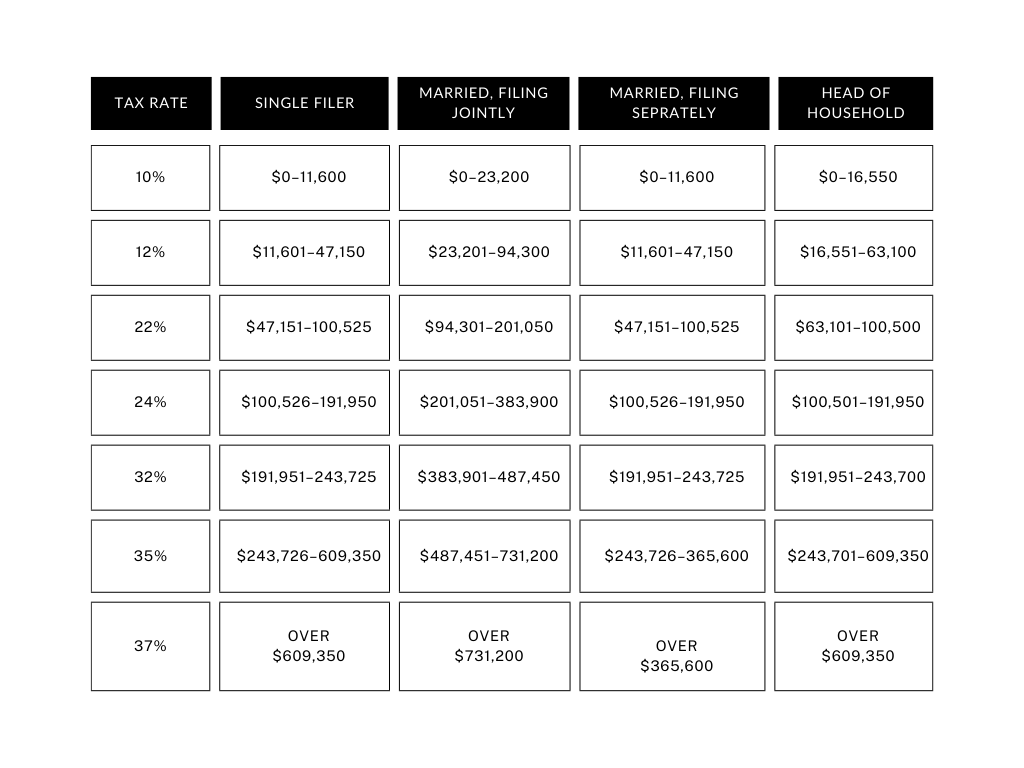

The 2024 Tax Bracket: Where Do You Stand?

Tax Rates and Tax Brackets

Once you’ve determined your taxable income, you can figure out which tax bracket you’re in (which is based on your taxable income and filing status).

Single Filers

- Making up to $11,600? You’re in the 10% bracket

- $11,600–$47,150? Welcome to 12%

- $47,150–$100,525? You’ve hit 22%

- See below for continued tax rate

Helpful Resources

Gathering Documents: What You Need

Click here to get BSW’s Tax Preparation Checklist

- Your Social Security number (and those of any dependents)

- Last year’s tax return (it’s a helpful reference)

- W-2s from employers

- 1099s for freelance work or investments

If You’re Itemizing

- Charitable donation receipts

- Mortgage interest statements

- Medical expense records

- Business expense documentation

Good News: Higher Standard Deductions for 2024!

The IRS has given us a little inflation adjustment:

- Single Filers: $14,600 (up from last year)

- Married Filing Jointly: $29,200

- Married Filing Separately: $14,600

- Head of Household: $21,900

Make Tax Season Work for You: Pro Tips

- Start Early: Give yourself breathing room to gather documents and ask questions

- Stay Organized: Create a dedicated folder (physical or digital) for tax documents

- Track Changes: Note any major life events from 2024 (marriage, new home, baby) – they affect your taxes

- Ask for Help: Whether it’s tax software or a professional, don’t go it alone if you’re unsure

Need Extra Support?

Remember: Taxes don’t have to be taxing! With a little preparation and the right resources, you can tackle tax season 2025 like a pro.

“Procrastination is the art of keeping up with yesterday.” – Don Marquis

Don’t let that be your tax motto! In the spirit of preparation and progress, don’t let tax season sneak up on you. Take charge, get organized, and make this year’s tax filing as seamless as possible. We’re here to support you, so feel free to reach out if you need connections to professionals or additional guidance. Here’s to a smooth tax season and more time for what truly matters in life!

This information is provided by BSW Wealth Partners, Inc., a Public Benefit Corporation (“BSW”) for informational purposes only. The opinions expressed are our opinions and should not be regarded as a description of services provided by BSW or considered investment, legal or accounting advice. Certain information cited is from third-party sources and while we believe the information to be accurate and true to the best of our knowledge, we cannot guarantee its accuracy as there may be certain unknown omissions, errors or mistakes. Use of third-party information, including links, is in no way an endorsement by BSW.

This information does not constitute investment or tax advice. Moreover, you should not assume that any discussion or information contained herein serves as the receipt of, or as a substitute for, personalized tax advice from a certified public accountant or other tax professional. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the tax advisor of his/her choosing. BSW is neither a law firm nor a certified public accounting firm and no portion of the content should be construed as legal or accounting advice. A copy of BSW’s current written disclosure statement discussing our advisory services and fees is available upon request.