Welcome to summer. As Ella Fitzgerald, the First Lady of Song, use to croon, “Summertime, and the living is easy. Fish are jumping and the cotton is high. Oh, your daddy’s rich and your ma is good-looking.”

The living around our home office in Boulder has indeed been easy – sunny afternoons, temperatures in the 80s and white, puffy clouds dot spacious, brilliant blue skies. We hope that wherever you find yourself this summer, you can take time to tap into whatever makes your living “easy”; whether that be relaxing on the porch on a warm evening, cooling off in your favorite body of water, or just enjoying friends and family around a picnic table. These are the sweet memories that we store and pull out in mid-February to keep us going through the short, cold days of winter.

Returning to Ella’s lyrics, if “daddy” had some money in the stock market during the first half of this year he would indeed be rich – or at least more well-off than at the start of the year. Through June 30, BSW’s primary benchmark, the All Country World Index (ACWI) rose 16.07%. Even bonds have done well. The bond index that we watch, the Bloomberg Barclays U.S. Aggregate, chocked up a total return of 6.06%. This increase seems to be largely due to interest rates steadily falling during the period. More on this dynamic/predicament/challenge below.

Undeniably, nearly everything thus far has been sunny and bright. However, when we peer over the bridge of our sunglasses, we see reasons to keep the raincoats close at hand.

Plain and simple, based on our valuations there are no asset classes that can be considered cheap anymore.The margin for error seems thin and there are plenty of political, policy and market forces that could bugger things up. First and foremost is the continued trade war.

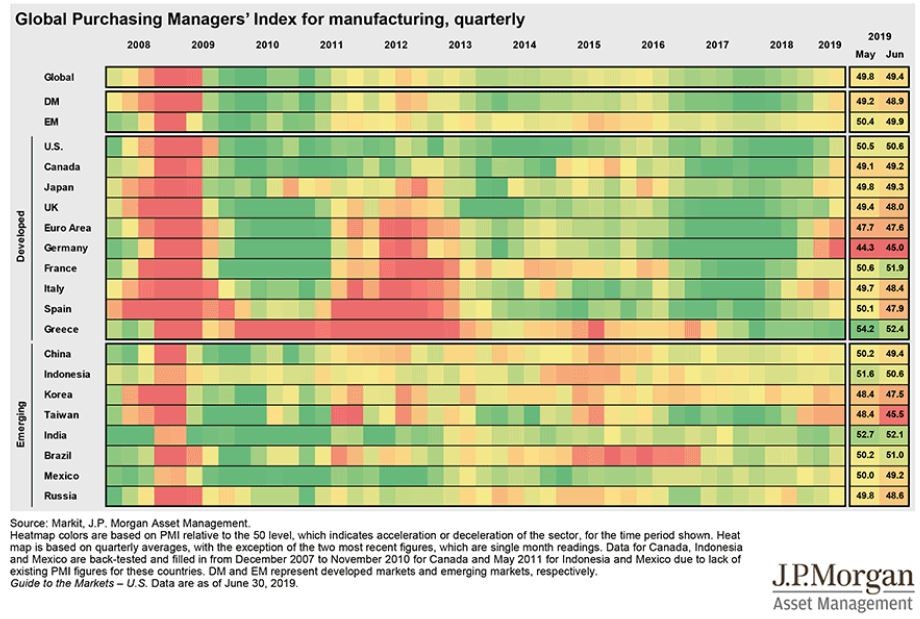

The primary ripple effect of the tariff war can be seen clearly in the chart below. Manufacturing is slowing amongst the big exporters like Germany, South Korea and Japan, but is also ominously spreading to other peripheral countries as well. What used to be all go-go green in the chart just a year ago is now different shades of red and orange to the far right.

Uncertainty is high and capital expenditures for business are plummeting. There are indications that most firms don’t want to expand or make large outlays for equipment or staff if the tariff wars continue or get worse. Trying to handicap the POTUS’ next move in the ongoing back and forth with China is an exercise in futility.

As mentioned, we have also seen interest rates fall as bond prices have steadily risen this year. This has been contrary to the historical relationship between stocks and bonds (bond prices traditionally fall when stock prices rise). This is because when stocks are rising, it means that the economy is heating up (or at least doing well) which then increases expectations for higher inflation. As inflation expectations rise, bond yields usually rise (bond prices fall) in order to preserve purchasing power. Recently though, even a strong stock market has not stoked fears of inflation. And in developed foreign areas of the world, deflation has become a bigger worry.

The stock market and bond market are telling us two different things this year. Stocks are saying, “Jump in, the water’s fine.” Bonds are saying, “Be careful. There may be rocks under the surface.”

Which one is right? It might take a while to find out. In the meantime, BSW believes it’s prudent to stay invested, but to be diversified and manage risk and expectations (we don’t expect the second half to look like the first). In our opinion, managing risks includes seeking out those areas of the market that are not priced for perfection. Those include emerging market stocks, select high-quality municipal bonds and unique opportunities within the private investing space – including both real estate and niche private equity.

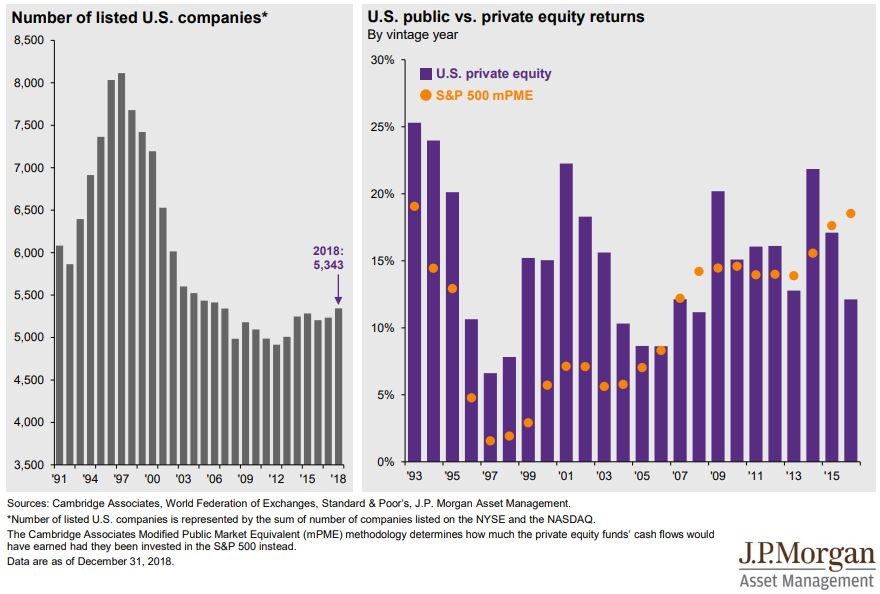

It’s well known that there is a wall of money waiting to be invested in private equity. What’s not as well known is that the number of listed U.S. companies (meaning the number of stocks available to purchase) has been shrinking over the last decade – from a high of 8,000+ to recently just over 5,000. There seem to be multiple reasons behind this such as: more regulatory hoops to jump through, tech firms wanting to guard innovative ideas and simply the shear availability of money accessible to growing private companies (thank you Federal Reserve policy).

This means that there may be increasingly more opportunities for long-term growth outside of traditional public stocks, as firms decide to stay private instead of selling shares to the public. Private company investment candidates are no longer assumed to be high-tech firms with big dreams and no earnings. They span all sectors, market caps and industries. BSW has made great strides in making investing in this growing part of the market more accessible, cost effective and sustainable. Thanks to the Private Investments team of Elias Bachmann and Aaron Deitz for all their great work on this front!

Lastly, (making this a shorter one so you can get back to your barbecuing) BSW is watching the Federal Reserve for indications of their intentions to lower or hold rates steady. The market has already priced in assumptions of 1 to 2 25bps rate cuts, so any diversion from this path may cause a hiccup.

There is a catch here though…With almost $10 trillion of assets around the globe priced to yield <0% (an investor is guaranteed to get back less than their original investment at maturity), investors may be at a point where lower rates will no longer spur growth. Despite this, central banks around the world continue to use loose monetary policy to counter the negative effects of the trade war.

Said another way, you can’t force people to borrow or invest – at least not in most countries. Further, an investment that didn’t make sense when a company could borrow at ridiculously low rates doesn’t suddenly make sense at stupid low rates.

In our opinion, the best hope for continued strength in the market is: 1. Some form of truce in the trade war with China (the re-globalization of commerce), 2. A normalization of interest rates (which may mean near-term bond price weakness) and 3. Proof of real earnings growth, not growth engineered through stock buybacks or merger and acquisition activity.

However, because our belief that the order of operations of the above needs to be: 1, 2, then 3, we aren’t holding our breath. Although, that doesn’t mean investors can’t have perfectly adequate returns over the remainder of the year – returns fueled by hopes for a trade truce, the need to put money to work in assets earning more than nothing and the belief that lower rates will magically elevate markets.

While hope and need has worked all year, this is not an environment where we want to reach for returns. BSW will be spending most of the remainder of the year looking out for the rocks under the water and protecting those returns that the markets have delivered thus far.

BSW is here to ensure you can enjoy your summer “easy” time. We will be taking care of the not so easy task of navigating risks and finding opportunities so you can reach your long-term goals.

Thanks for reading.

Craig Seidler

Director of Public Investments