Schools, gyms, and restaurants are going into lock down, and markets are struggling to find a footing. The illustration below reminds us that once crisis is solved, we turn our attention to the next crisis to come. This is not meant to be glib, but a sobering reminder that this pattern is often hard-wired into our brains.

If you have a moment, take a quick look at the video below.

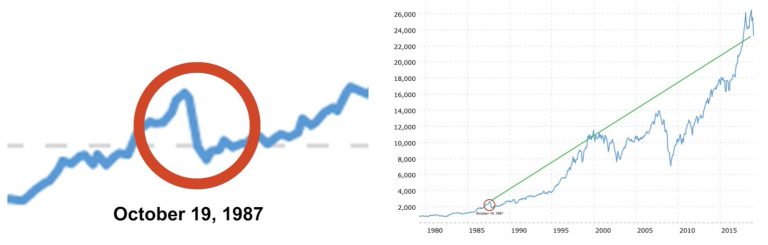

Black Monday, October 19, 1987 was (and still is) the biggest one-day percentage drop for US markets. Imagine if you took a time-machine back to October 19, 1987. The Dow had just closed at 1,738. The prevailing sentiment is panic and uncertainty. But you know that on March 18, 2020, it will close at 19,899. That’s a 1,145% gain, inclusive of the current bear market (thus far) from COVID-19. Looking back now on the video from 1987, it’s tough to reconcile just how bad it felt at the time.

Black Monday 1987 from two perspectives – one in the moment, another in hindsight. BOTH are accurate. (Note: Black Monday is the tiny circle in the chart at right – data through 03.2020.)

There’s a reason that every panic in the past looks like an opportunity – and every panic in the future looks like a risk. They are the exact same things, but we react entirely differently to them. One is terrifying. One is an opportunity. Yet both are the same thing. It happens again, and again, and again.

This current crisis is unlike any crisis we’ve ever experienced. How many people will be affected? How long will the quarantines last? What will be the economic effects? Yet the current crisis is also identical to every other crisis we’ve experienced. Examples: Will there be more terrorist attacks (following 9/11)? Will the financial system collapse (following 2008)? Let’s acknowledge that we can’t know what we can’t know.

But here’s one thing we DO know, with 100% certainty: It’s not a question of IF we will get through this current crisis, it’s just a question WHEN.

Here’s another thing we know with 100% certainty: We will remain steadfast. We will not be reactive. We will not make knee-jerk decisions. We will not shoot from the hip. We will not go to cash, start buying puts, trade the VIX, etc. We will help our clients and others be smart and act accordingly. Because that’s how you win.

Here’s the last thing we know with 100% certainty: The odds are on our side. The collective intellectual and technological capacities of the global pharmaceutical and biotech industries, and the indomitable will of humanity, is being unleashed on COVID-19. As in every other crisis, our drive, determination, ingenuity, resilience and the incredible magic of people working together will prevail.

David Wolf, CEO